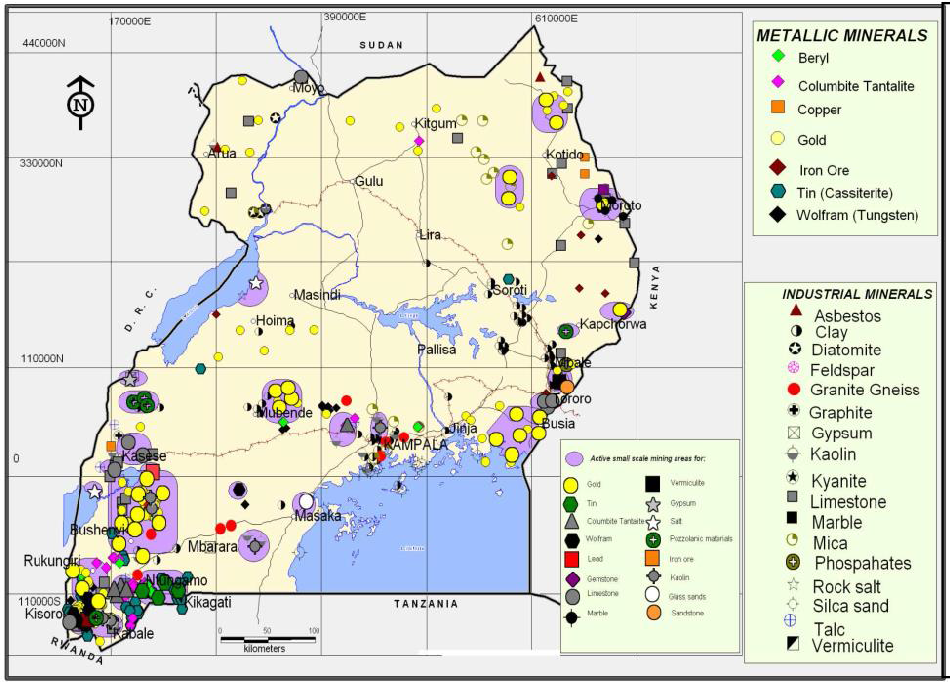

Uganda Gold Deposits, Uganda is one of Africa’s fastest-growing gold hubs, with major deposits discovered in regions like Mubende, Karamoja, Buhweju, Busia, and Moroto.

Steps to follow when choosing a gold deposit in Uganda:

Conduct Geological Surveys and Exploration

Always work with certified geologists or mining consultants to conduct preliminary geological surveys, use remote sensing, geochemical sampling, and aerial mapping to identify potential gold-bearing areas and focus on regions like Karamoja, Mubende, Buhweju, and Busia, which are known for gold deposits. Uganda Gold Deposits

- Verify Legal Ownership and Licensing

Confirm the land’s legal ownership and whether it falls under protected areas or active mining concessions, always apply for the appropriate exploration or mining license through the Directorate of Geological Survey and Mines (DGSM) under the Ministry of Energy and Mineral Development, and avoid illegal or unlicensed gold areas to protect your investment and avoid prosecution.

- Assess Deposit Quality and Quantity

Always perform core drilling, trenching, and assay tests to determine Gold grade (grams per ton), Ore body size, and Extraction potential.

Always use certified labs for accurate testing, and ensure your findings are economically viable before proceeding. Uganda Gold Deposits

- Evaluate Accessibility and Infrastructure

Always check the deposit’s access to roads, water, electricity, and labor; areas with remote or inaccessible areas may significantly increase operational costs, and also, assess security risks in the region, especially in volatile areas like Karamoja.

- Conduct Environmental and Social Impact Assessments (ESIA)

Uganda’s laws require all mining operations to undergo an Environmental and Social Impact Assessment, engage with local communities, conduct stakeholder meetings, and obtain a Certificate of Approval from NEMA (National Environmental Management Authority).

Always ensure that your project aligns with sustainability and social responsibility standards. Uganda Gold Deposits

Uganda exported gold worth $1.9 billion to the UAE, $1.4 billion to South Korea, and $28.7 million to Hong Kong in 2019–2020. New deposits could elevate Uganda to a top African gold exporter, rivaling Ghana and South Africa.

Uganda’s gold deposits offer diverse investment avenues, from purchasing physical gold to investing in mining operations.

Gold Buyers Africa Limited facilitates access to these opportunities, ensuring ethical sourcing and competitive pricing.

- Vast Untapped Gold Reserves

Regions like Karamoja, Mubende, Buhweju, and Moroto remain underdeveloped, giving investors a first-mover advantage to explore high-grade ore bodies.

- Low Operating Costs

Labor, land, and equipment costs are relatively low in Uganda compared to other African mining hubs. This makes it ideal for small- to mid-sized mining ventures.

- Government Support & Reforms

The 2022–2025 Mining and Minerals Act introduced incentives like

- Tax holidays for licensed miners

- Simplified licensing through the online cadastre portal

- Export-friendly gold trade regulations

- Access to Regional Markets

Uganda borders South Sudan, Kenya, Congo, and Rwanda, making it a strategic location for gold trade and cross-border exports.

- High Purity Levels (22K–24K)

Uganda’s gold is often over 90% pure in its natural form, which increases its value and makes refining easier and cheaper. Uganda Gold Deposits

Types of Gold Available

- Gold Bullion Bars

Source: AGR (Uganda), CEEC (Congo), Rand Refinery (South Africa).

Purity: 99.9%–99.99% (24K).

Sizes: 100g, 1kg, up to 12.44kg (Good Delivery bars).

Price: $81,000–$84,000/kg in Uganda, $80,000–$83,000/kg in Congo (June 2025, spot $83,330/kg).

Use Case: Wealth preservation, institutional investment.

Why Invest in Uganda’s Gold?

Diversification: Gold hedges against inflation, with prices up 20% from 2023 ($2,600/oz).

Competitive Pricing: Uganda’s gold is 5%–15% below global rates due to direct sourcing and low operational costs.

High Purity: 24K bullion bars and coins meet LBMA standards, ideal for investment.

Ethical Sourcing: Gold Buyers Africa Limited ensures conflict-free gold, adhering to planetGOLD and Fairmined standards.

Growth Potential: Rising exports ($2.3 billion in 2023) and new mines signal strong market growth.

Leave a Reply